|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. And, I’ve been featured in the book Market Wizards, alongside investors like Paul Tudor Jones. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

My trading strategy might seem unorthodox…

While some traders swing for the fences, I do the opposite. I aim to go into the market each day and take out lots of regular profits. It’s something I’ve been doing now for decades.

To be fair, I’m not going to get it right every day… no one does. There will be times when we take losses. But following this strategy has really put me ahead as a trader.

To show you what I mean, today and tomorrow I’m going to run through two trades (long and short) I did recently on the SPDR Gold Shares ETF (GLD) in my trading service, The Opportunistic Trader.

To be clear, we use a basic option buying strategy with this service. So, the returns we generated in this trade will be higher than if you had used just regular shares.

However, the point remains the same…

Whether you trade options, shares, or anything else, the goal is to go into the market and extract profits as often as possible.

I’d also like to highlight GLD because it’s one of those stocks that can make traders really emotional (anything gold related does).

By the time we closed out both trades for a combined 210% gain, GLD’s stock price was right back where it started.

Today, we’re going to focus on the first of those trades… we’ll come back to the second trade tomorrow.

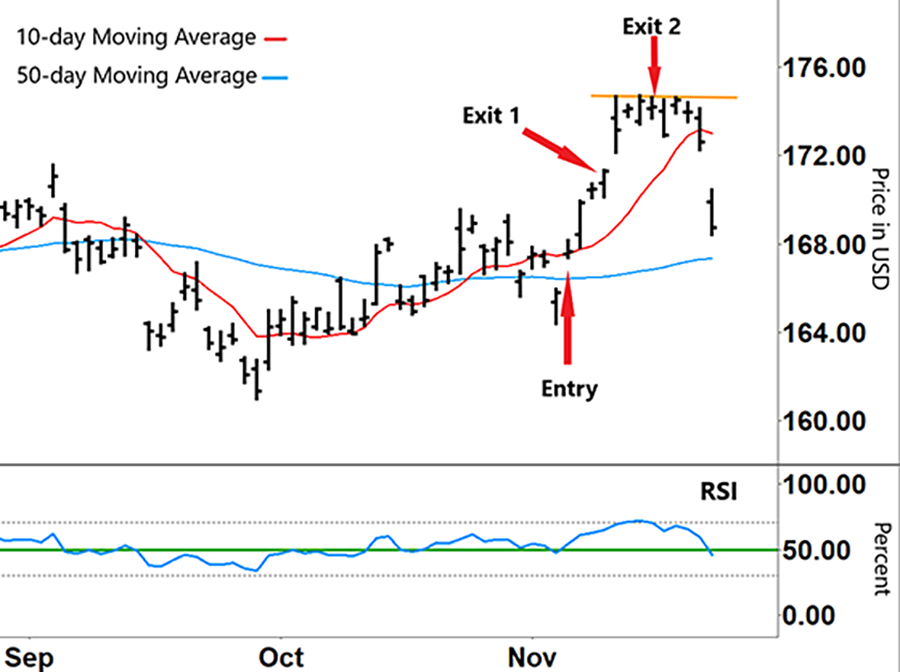

As you can see in the chart below, leading into our trade entry the short-term 10-day moving average (MA – red line) had crossed above the 50-day long-term moving average MA (blue line) just a week prior…

The Relative Strength Index (RSI) had also just bounced off its support line (50%) and formed a “V” the day prior to entering the trade, showing an increase in buying momentum…

SPDR Gold Shares ETF (GLD)

Source: eSignal

On November 4 we bought a call option on GLD that gave us the right (but not the obligation) to buy shares in GLD at any time prior to the option’s expiry.

As the chart shows, the trade immediately went our way. With our option already up around 50% – and the RSI quickly closing in on the upper grey line on the RSI (an overbought signal) – we closed out half of our position on November 9.

That represented a 47% gain in just five days.

Again, I want to stress that this represents a far bigger gain that what we would’ve achieved if we just bought the shares (2% gain).

The reason we took this profit on half of our position goes beyond just looking at the chart… (Remember, our goal is to go into the market and collect as many profits as we can.)

With our position up around 50% in less than a week, I was happy to lock in that size profit on half our position… we’d then let the chart determine where we’d exit the remainder of our position.

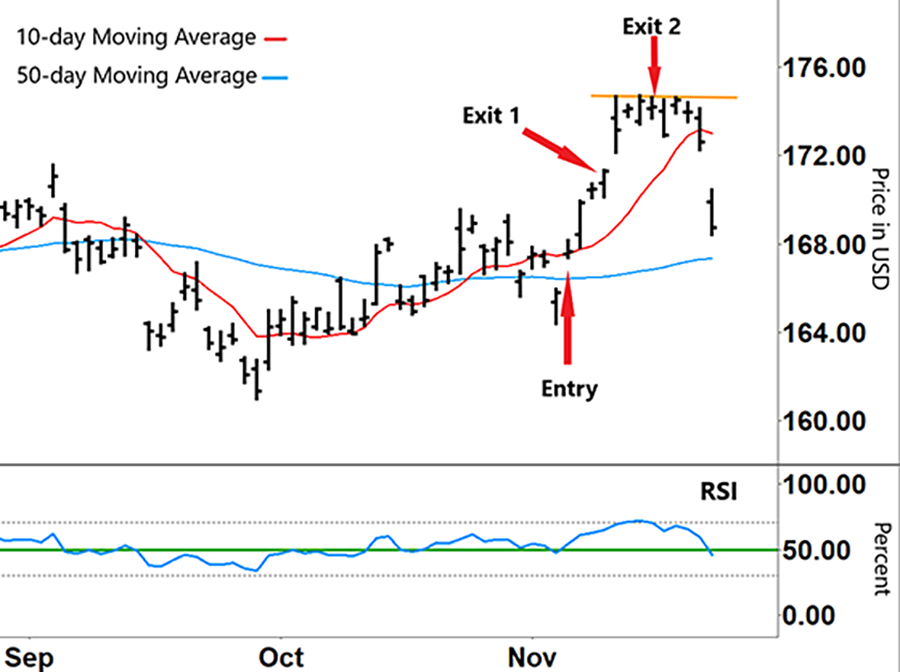

SPDR Gold Shares ETF (GLD)

Source: eSignal

With GLD starting to run into resistance (orange horizontal line), and the RSI in overbought territory and trending down, we locked in a 100% gain on the remainder of our position when we closed it out on November 15.

That combined for a 74% gain on our trade in just 11 days.

This kind of move higher in GLD always attracts those traders on the hunt for a big move.

But, just as they would’ve entered the trade in the hopes of an even bigger jump – and likely got stopped out – we’d already taken our profits and were preparing ourselves for the next trade.

Tune in tomorrow, and I’ll explain exactly what we did next… and how we made 135% shorting GLD a few days later.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

Reader Mailbag

I’m always excited to receive feedback from our avid readers. Here’s some of the most recent responses…

Thank you for your great layout of the newsletters. It’s very appreciated as an amateur trader that’s trying to learn and grow. Your focused messaging with simple clarifications on how the charts play out is a big help. I wish you and the team all the very best over the new season and holidays. God bless.

– Rohit

I’m constantly learning how to trade, and I’m amazed at how much more I still need to learn. Being in charge of my life is important, so thank you for any teaching moment that allows me to grow and understand trading.

– Rhea

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].