Note: The Industrial Revolution created the Carnegies and Rockefellers. The 1990s tech boom created Gates and Bezos.

Now it’s happening again. Our colleague Jeff Brown calls it a “Hyper Acceleration” – and he says it’s on track to be 12x bigger than the dot-com boom.

This isn’t Jeff’s first big call. He recommended Bitcoin at $240… Tesla at a split-adjusted $20… Nvidia at a split-adjusted 66¢. But he believes this may be his most urgent prediction yet.

To learn more about this “Hyper Acceleration”… and the biggest ways to profit from it… RSVP with one click for Jeff’s upcoming special event on August 20.

Folks who tune in to my Trading with Larry Live podcast each morning will know just how leery I am about the market. (We go live at 8:30 a.m. ET on Monday through Thursday.)

Insatiable buying by retail investors has pushed stocks to crazy valuations. And that’s made stocks vulnerable to a fall.

Buying a put option is one way to capture an anticipated fall, but it can have limitations…

For example, the expected move might take longer than planned to play out. Or the stock might not fall far enough for the trade to be profitable.

That’s where another option strategy fits into the picture…

Using a Bear Put Spread Strategy

A bear put spread is an options strategy you can use if you are bearish about the underlying stock. You buy and sell put options simultaneously (i.e., a spread).

The first leg of the trade involves buying a put option. The second leg involves selling another put option at a lower strike price. Both legs must have the same expiration.

Adding the second leg lowers your breakeven threshold. So the stock needs to fall less for your trade to be successful (compared to only buying a put option).

The downside is that this also limits your profit potential.

So, let’s look at a trade example to see a bear put spread in action. (This is not a trade recommendation.)

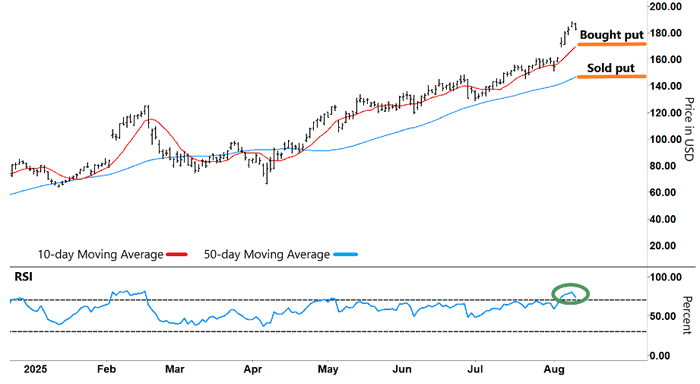

Below is a chart of Palantir Technologies (PLTR):

Palantir Technologies (PLTR)

Source: e-Signal

PLTR has enjoyed a massive run this year. It’s up about 147% year-to-date (YTD) – with its market cap recently exceeding $430 billion.

But the Relative Strength Index (RSI) shows it’s overbought (green circle). So you decide you want to capture a potential reversal.

To do so, you open a bear put spread.

In this example, you buy a $170 strike put with around two months until expiry. That costs you $9 (or $900 per contract – an option contract involves 100 shares). You simultaneously sell a put option at a $155 strike. You receive $5 (or $500 per contract).

Those two legs mean you’re out of pocket $4 ($400 per contract) to enter the trade.

Your breakeven on the trade is $166. That’s the bought put strike price ($170) minus $4. Generally speaking, PLTR has to fall below $166 before you recoup the cost of the trade and start to make money.

But if you just bought the put option by itself, PLTR would need to fall to $161 for you to break even. (That’s the $170 strike price less the $9 that the option costs.)

By placing the spread, you’ve lowered your entry costs from $9 to $4. You’ve significantly reduced the distance PLTR needs to fall for you to break even.

However, there’s a trade-off…

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Determining the Right Option Strategy

Entering a bear put spread also puts a cap on your profits.

Your max profit will be the $15 difference between your options’ strike prices ($170 and $155), minus the premium you paid out to open the position ($4).

So the most we can make on this bear put trade is $11, or $1,100 per contract. Even if PLTR fell way below $155, we’re not going to make any more money from the trade.

That’s an important consideration when you’re debating what options strategy to use.

By buying a put outright, you can potentially generate bigger profits. But the stock needs to fall further to reach breakeven.

With a bear put spread, your profits are capped. However, the stock doesn’t have to fall as far to reach breakeven… That increases the trade’s chance of success.

Ultimately, choosing between the two trades comes down to how confident you are in the anticipated move.

If you’re convinced that a stock is going to fall heavily, then a bought put is often the right way to go.

But if you’re unsure about the size of that move, then consider the bear put spread instead.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |