One by one, signs of a bubble keep appearing.

The present setup rivals some of the runups leading to the biggest stock market busts in history.

For instance, the top 10% of the largest stocks in the U.S. now make up 76% of the entire stock market. They’ve even surpassed the concentration seen in 1929, just before the market crashed and the Great Depression hit.

Plus, valuations are surging to historic levels.

A composite valuation indicator combines things like the price-to-earnings and price-to-book ratios. Now it is reaching levels last seen in the late 1990s internet bubble and 1929.

All signs point to investor euphoria. But things are getting downright silly.

It all shows that the bull market is on borrowed time…

Meme Stock Mania

Following a controversial advertisement featuring actress Sydney Sweeney, American Eagle (AEO) added as much as $400 million to its market value within 24 hours.

There was no other news or financial update… just an ad for blue jeans.

Meme stock mania is making a comeback, and AEO is hardly the first stock to shoot higher with little fundamental reason as to why.

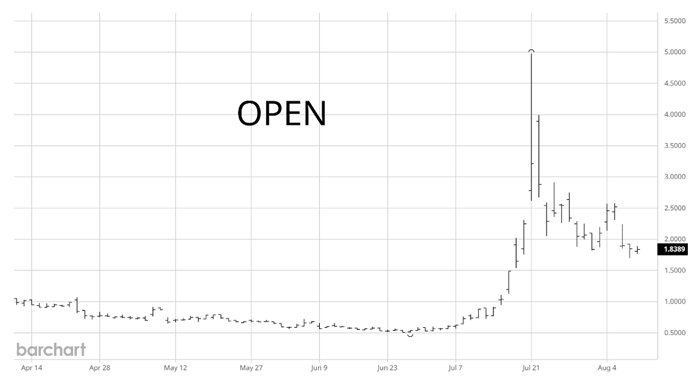

Take the shares of Opendoor Technologies (OPEN) as another example. On July 14, it was trading at $0.90. Just a week later, the stock had jumped as much as 452%. Here’s the chart:

There was no major news, acquisition, or earnings report. A hedge fund manager made a social media post touting the stock. That triggered a swarm of buying into OPEN shares.

The moves are reminiscent of the internet bubble in the late 1990s… just ahead of a multiyear bear market that saw the S&P 500 lose 50% of its value.

Or think back to the first time meme stocks took off in 2021, just ahead of the bear market the following year. Remember Roaring Kitty and GameStop (GME)?

The growing appetite for meme stocks shows that speculative froth is reaching extremes.

And it signals that the rally is sucking in the last remaining buyers.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Retail Investors Are Plowing Into Stocks

Stock valuations and market concentration are running at historically extreme levels. So is trading activity by retail investors.

The risk appetite of retail investors is driving nonsensical moves in the stock market, like these meme stock moves.

Retail investors are making their presence felt like never before.

Early in my career, the retail investor share of total trading volume was less than 2%. Now that share has hit 20% or more.

If you look at retail’s share in single stocks, it’s at a record level this year. And retail’s share of option volumes hit a record at 21% of the total.

So while the economy faces threats from rising inflation, a slowing labor market, and uncertainty over interest rate cuts, the fundamentals don’t seem to matter anymore as retail investors throw their weight around.

But the disconnect between irrational stock movements and the underlying economy can only hold up so long.

We’ve seen all of this before in the runup to previous bubbles bursting… Once the general public hits this level of exuberance, you know the end of the bull market is getting close.

Of course, this doesn’t mean you should pull all your capital out of the stock market this instant. But it’s time to be wary.

These types of moves can create incredible volatility. And traders who know how to take advantage can end up with extraordinary profit opportunities.

Lately, I’ve been sharing about a way to turn volatile moments into rapid-fire wins… with profits in 24 hours or less. Wins of 196%… 223%… and even 605% aren’t out of the question. I also shared one of my favorite tickers for trading these opportunities.

If you’d like to learn more, then I’d encourage you to watch my recent briefing here. I’m already looking for my next trade, so don’t wait too long…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |