Yesterday, the Federal Reserve kicked off its widely anticipated September meeting. Its interest rate decision comes today.

The market is hanging on every word of Fed Chair Jerome Powell’s press conference and his expectations around cutting rates in the months to come.

But this week also marks another important event on the financial calendar… In fact, it’s something I’ve traded profitably for years.

The good news is that my followers had the chance to bring home a blended 36.4% profit in an option trade that barely took a few hours.

So what was behind this quick gain?

One of My Favorite Options Trades

This trade revolves around a phenomenon called Quadruple Witching Day. It happens four times a year.

It’s when index futures and options, plus stock futures and options, all expire on the same day. That’s the third Friday of March, June, September, and December.

Quadruple Witching is one of my favorite times to trade during the year due to all these expirations…

All the big fund managers and other financial institutions need to be out of these futures and options before they expire. That means trading volume increases dramatically leading up to expiration. That pushes volatility upward as they race to close out their positions.

With all that money sloshing around, I look for pricing anomalies to trade for quick gains.

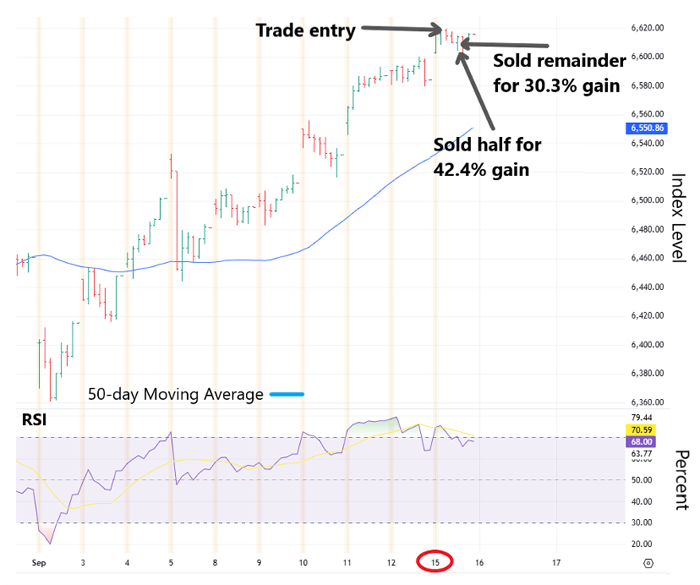

As you can see in the chart below, the S&P 500 (SPX) initially rallied on Monday (each bar on the chart represents an hour’s trading).

However, we soon saw a wave of selling come through the market…

S&P 500 (SPX) – Hourly chart

Source: TradingView

To capture an emerging reversal, we bought an SPX put option with a September 19 expiration. A put option increases when the price of the underlying index falls.

As you can see, we got the direction right – the weight of that selling over the next few hours saw SPX steadily track lower.

We decided to lock in some profits by exiting half our position for a 42.4% gain. With that profit banked, we continued to hold the remaining half to benefit if the trade kept moving in our favor.

However, price action can reverse quickly. So you’ve got to keep a close watch…

SPX rose higher, so we exited the remaining half for a 30.3% gain. That equated to a blended 36.4% gain in mere hours.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Volatility’s Role in Options Trading

Volatility played an important role in this gain. That’s because it has a strong influence on options pricing. If you enter a trade right before volatility starts rising, it can really put the odds in your favor.

In this case, we were able to enter the trade during low volatility. Then over the course of the day, the CBOE Volatility Index (VIX) rose from 14.7 to 15.8. Because of this, we made a tidy profit even when the trade started moving against us.

To be clear, we generated this profit by using options. Because options use leverage, they magnify losses and gains.

And because options expire, time decay constantly eats away at their value. So you need to be confident that the anticipated move will play out well before the option’s expiration.

That becomes even more critical with Quad Witching trades since their expiration is just a few days away.

Yet as this trade shows, options can help you capture quick, sharp moves. And that’s how we were able to bank a respectable profit in a short time.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. Quadruple witchings are some of the quickest trades I do, as we’re guaranteed to be out in less than a week.

But as quick as they are, they’re not the fastest… My 0DTE trades get you in and out in less than 24 hours. And when we get it right, you can double your money or more in less than a day.

Here’s what some of my followers have reported:

Hi Larry, I got a little lucky on the April 10 QQQ 0DTE trade with a favorable entry and exit… pretty happy with the results… 200% gain! It’s all about timing and some good luck…

– Chuck C.

My entry price was $1.25. My blended profit was 88%. Not bad for the first trade of this kind.

– James M.

Hi Larry, I did very well on the 0DTE QQQ trade. 71.6%. I entered the trade on your alert on Tuesday. I exited the trade just before I received your alert on Wednesday.

– Dave W.

Love 0DTE trade of PLTR. I got 122% return on it. Bought $1.48 around 10 am on Thur after your alert and sold on same day around 3 pm when I saw my position DBLed. Sold $3.30. After commission, I realized over 122% gain! Love it.

– Xigping M.

So if you’d like to learn more about zero-day trades… and make sure you’re ready for the next quad witching trade too – simply go right here for the full story.

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |