Larry’s Note: I’ve traded the markets for over 40 years now. And there’s one strategy that has been one of my most consistent income producers during that time. It’s a strategy that pays out almost every day the market is open… and helped me bring in $95 million in profits in one year during my hedge fund days.

Over nearly five years, I’ve been sharing this strategy with my followers… and we’ve beat the S&P’s returns by 4.6X on an annualized basis. That’s why I want to share it with you too…

If you missed this week’s 12 Months to Retirement event, then I’d encourage you to check out the replay now before it goes online.

There’s absolutely no volatility to be found in the stock market.

But that doesn’t mean investors should relax.

The S&P 500 has spent 108 consecutive sessions above its 50-day moving average. It may seem like stocks can do nothing but rally. But the S&P has recently been doing something never seen before.

Through October 3, the S&P was up five consecutive days in a row. But over the same five-day stretch, the CBOE Volatility Index (VIX) was also up.

That’s never happened before over a five-day period. The VIX is referred to as Wall Street’s fear gauge. Volatility tends to fall when stocks are rallying.

If they’re moving in the same direction, that means there’s a disconnect.

So the growing divergence should put you on alert for an algo-driven jump in volatility…

A Volatility Spark

When it comes to triggering a massive jump in volatility, all it takes is some dry kindling and a spark.

That’s due to the growing popularity of “volatility-targeting” and “risk-parity” strategies among institutional investors. The names might sound complicated, but the way they operate is pretty simple.

These volatility funds operate their portfolios on a risk budget… similar to how you might think of your household budget.

If you go over your budget, it’s time to make cuts somewhere. Volatility funds cut when their risk is getting out of hand.

For stock prices, volatility is how you measure risk.

When volatility is jumping higher, these funds are forced to cut their stock market exposure to stay within their risk budget.

The sums in these funds are staggering and are estimated at up to $2 trillion.

That’s why bad things can happen to stock prices when volatility funds head for the exits all at once.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

A Tsunami of Selling

Typically, the quantitative funds that I’m describing deploy computer algorithms to implement their strategy.

Once the algos pick up on a signal that volatility is increasing, they rush to sell stocks to bring portfolios back into balance. Now imagine them doing this on a scale encompassing trillions of dollars in assets.

That’s why it may feel like a trap door is waiting underneath the market… and why “waterfall declines” are becoming more frequent. (A waterfall decline describes a sharp, relentless drop in stock prices, usually with few upward moves in between.)

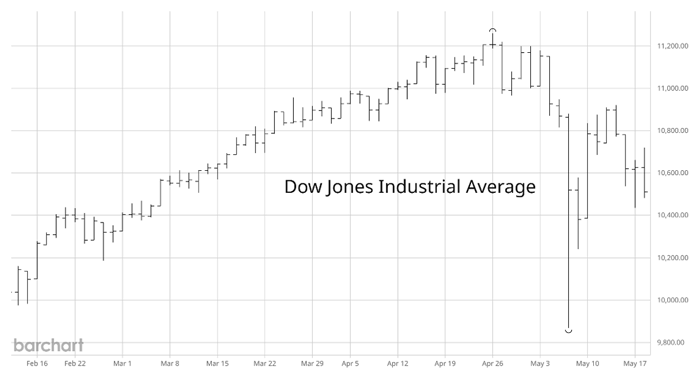

There have been some famous waterfall declines over the years. You might recall the flash crash on May 6, 2010, when the Dow Jones dropped 9% in just minutes (see the daily chart below). That wiped out nearly $1 trillion in market value. An algorithm helped trigger the event with a massive sell order.

There was also “Volmageddon” in 2018. Algorithms helped trigger a spike in the VIX of 115%… one of the largest single-day gains in history. A fund tracking volatility was forced to liquidate, which wiped out billions in investor capital.

We’ve even seen the trap door made worse by algorithms several times during this AI-fueled bull market. That includes the spike in the VIX in August 2024 when the S&P 500 lost as much as 7% in just three trading sessions.

Algos also worsened the stock market’s plunge around the trade war heading into April this year. Recall that the S&P 500 lost 12% in just six days. We even fell into a bear market from the prior peak on an intraday basis.

Now artificial intelligence is increasing the power of algorithmic traders. But by staying aware of how the algorithms actually work, you can stay one step ahead of the stock market’s next big move.

If you haven’t already been tuning in to Trading With Larry Live during the week, I’d encourage you to check it out for my latest thoughts on the market pullback I see around the corner…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |