Markets have gone into countdown mode with the Federal Reserve’s meeting next week.

While a 0.25% cut is essentially guaranteed, any cuts beyond that sit at the heart of the ongoing speculation. And conflicting data is complicating the picture…

The jobs market continues to weaken, highlighted by this week’s huge 911,000 revision lower in annual nonfarm payroll numbers. But inflation data hasn’t been as clear.

Take the Producer Price Index (PPI), for example…

After July’s big 0.7% month-over-month (MoM) increase, this week’s PPI print for August showed a 0.1% drop. That could even help lay the groundwork for a potential 0.5% cut next week.

The data divergence creates another layer of uncertainty to deal with next week.

However, among all the noise, we’ve been quietly getting on with business and banking profits…

Tesla’s Triangle Pattern

One stock I love to trade is Tesla (TSLA)…

It sits at the forefront of several technology trends, like artificial intelligence, supercomputers, and autonomous driving. But comments from its CEO, Elon Musk, can really move the stock price around (among other factors).

That makes it great for trading… The key is to identify strong setups on the chart.

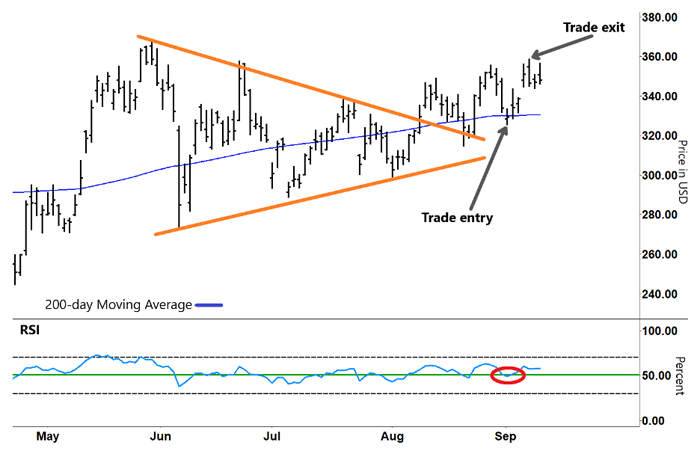

In the chart below, the orange lines identify a consolidating triangle pattern. When a stock rallies and then goes into a triangular pattern like this, its next move is often to break out higher.

And that’s what we saw here…

Tesla (TSLA)

Source: e-Signal

Once resistance is broken, it can often transition into support (and vice versa). So after breaking out of a triangle pattern, a stock will also often come back to test the upper level of the triangle.

In this case, TSLA held that upper level after the breakout. It subsequently rallied strongly from this level on August 22 and retraced after its August 27 peak.

So it came up on our radar as a potential long trade.

Plus, I was watching other signals…

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Technical Indicators to Watch

TSLA was right around the 200-day moving average (MA, blue line). That was another likely support level. And the Relative Strength Index (RSI) also held and formed a “V” off support (green line inside red circle).

That set TSLA up for a potential mean reversion trade to the upside.

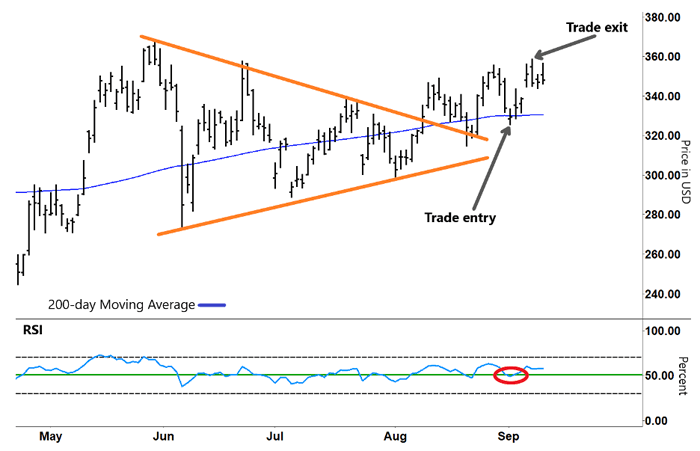

To capture an anticipated bounce, we bought a call option on September 2. A call option tends to increase in value when the underlying stock rallies.

Happily, TSLA rallied along with a rebound in momentum. Then, as that momentum developed further, TSLA gapped higher.

Our trade was in good profit (and the rise in momentum started slowing), so we decided to exit on September 8. We generated a tidy 38.0% gain in just six days.

Take another look:

Tesla (TSLA)

Source: e-Signal

We generated this return so quickly by using options. Because options use leverage, they magnify losses and gains. And, of course, options expire, so you need to be confident that the anticipated move will play out before the option’s expiration.

Yet as this trade shows, options can capture unfolding moves to help you bank some serious gains in just a few days.

The key is to look beyond all the noise and focus on strong trade setups…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. Much of the focus next week will be on the Fed’s meeting. And as always, I’ll be on the lookout for my next profitable trade…

As I mentioned at Wednesday’s Fed Decision Advance Warning briefing, the Fed meeting isn’t the only big event taking place next week with the potential to deliver outsized profits.

But time is slipping away fast. If you want to be ready to trade this opportunity by Monday, then I’d recommend watching the replay of this important briefing now.

Next week should be very exciting…

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |