One of the key things I look for in any trade is momentum…

And I’m not just talking about buying momentum, which can propel a stock higher and provide the setup for a potential long trade.

I also watch for changes in momentum… like when momentum reverses from selling to buying (or vice versa). That shift can often lead to a stock’s change in direction as well.

Today, I want to show how I used momentum on a recent trade from my options service, The Opportunistic Trader.

By using momentum to trade JPMorgan Chase (JPM), we generated about a 90% return in just under a week.

A Change in Direction

Like most other stocks, JPM had been heading down all year.

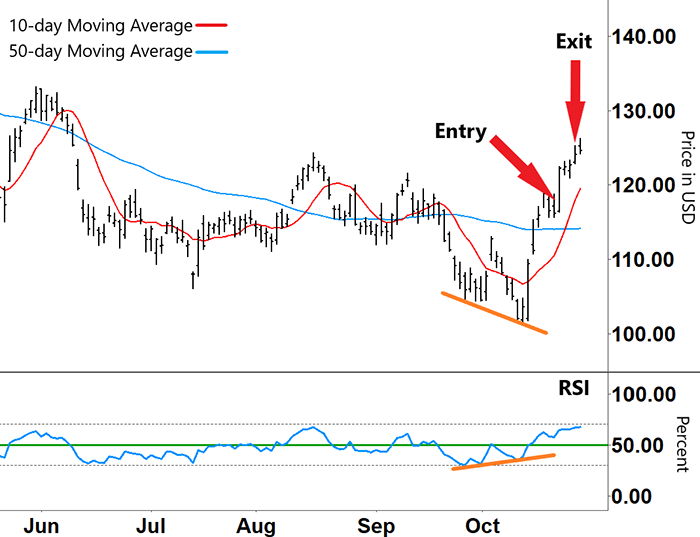

On the chart below, the 50-day moving average (MA – blue line) shows the overall downtrend…

JPMorgan Chase (JPM)

Source: eSignal

Among this major trend, we saw lots of smaller countermoves shown by the 10-day MA (red line).

And it’s the action from September onward that I want to focus on today…

As you can see, the down move in mid-September kicked off with the Relative Strength Index (RSI) breaking below support (green line) into the lower half of its band.

The 10-day MA also bearishly broke lower and accelerated below the 50-day MA. That further confirmed the down move…

But at that point, the RSI warned of a potential change in momentum and direction.

As JPM was making lower lows (upper orange line), the RSI began making higher lows (lower orange line). When buying momentum outweighs selling momentum, then eventually a stock’s price will reverse and start to push higher.

And that’s what we saw with JPM.

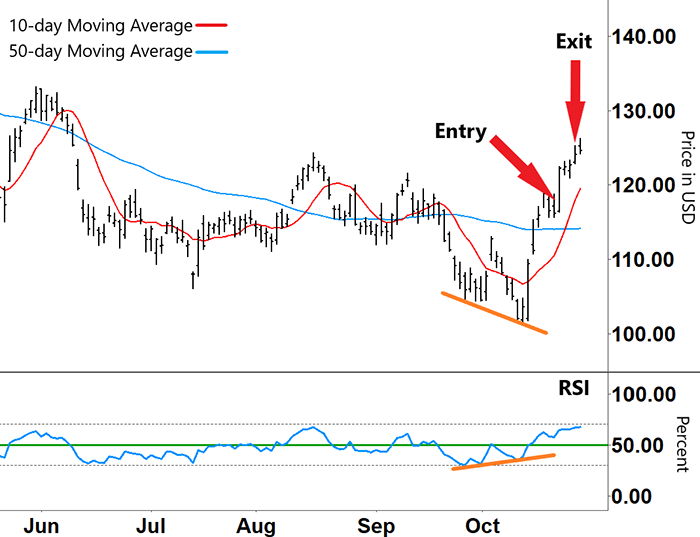

Take another look…

JPMorgan Chase (JPM)

Source: eSignal

The RSI burst up through resistance and gained traction in the upper half of its band. And JPM’s rally gathered strength.

JPM’s stock price jumping above the 50-day MA was another bullish signal. If that price action continued, then the 10-day MA would also cross back above the 50-day MA soon enough.

So with buying momentum behind it, we went long on October 20 by buying a call option on JPM.

Note that a call option should increase in value when a stock price rises. And that’s what happened, as increased buying momentum propelled JPM higher throughout the week.

Free Trading Resources

Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.

Taking the Win

We knew Amazon (AMZN) and Apple (AAPL) were about to release quarterly earnings… and that any miss could potentially send the broader market tumbling.

Likewise, the RSI was fast approaching overbought territory (upper grey dashed line).

So, we closed out our trade by selling our call options on October 26 for an 89.7% gain.

Remember, we’re not trying to get in on the next big trend. In a highly volatile market like this – that’s a low-probability way to trade.

Instead, we’re trying to capture a countermove (mean reversion trade) when a stock overshoots and heads back the other way – just as happened here with JPM.

To be clear, we generated this high return using options. But even if we had used just JPM shares, we still would’ve booked a nice (even if smaller) gain in less than a week.

Ultimately, this trade highlights that by watching momentum closely, we can find strong setups for profitable trades.

Larry Benedict

Editor, Trading With Larry Benedict

P.S. If you’re interested in learning more about how I trade options in The Opportunistic Trader, please check out more info right here.

Reader Mailbag

In today’s mailbag, a One Ticker Trader shares his experience with Larry’s recommendations…

In the past 11 weeks, I’ve made 11 trades with an average profit of 32.4%. Larry, I believe you are the real deal!

– Larry L.

Thank you, as always, for your thoughtful comments. We look forward to reading them every day at [email protected].